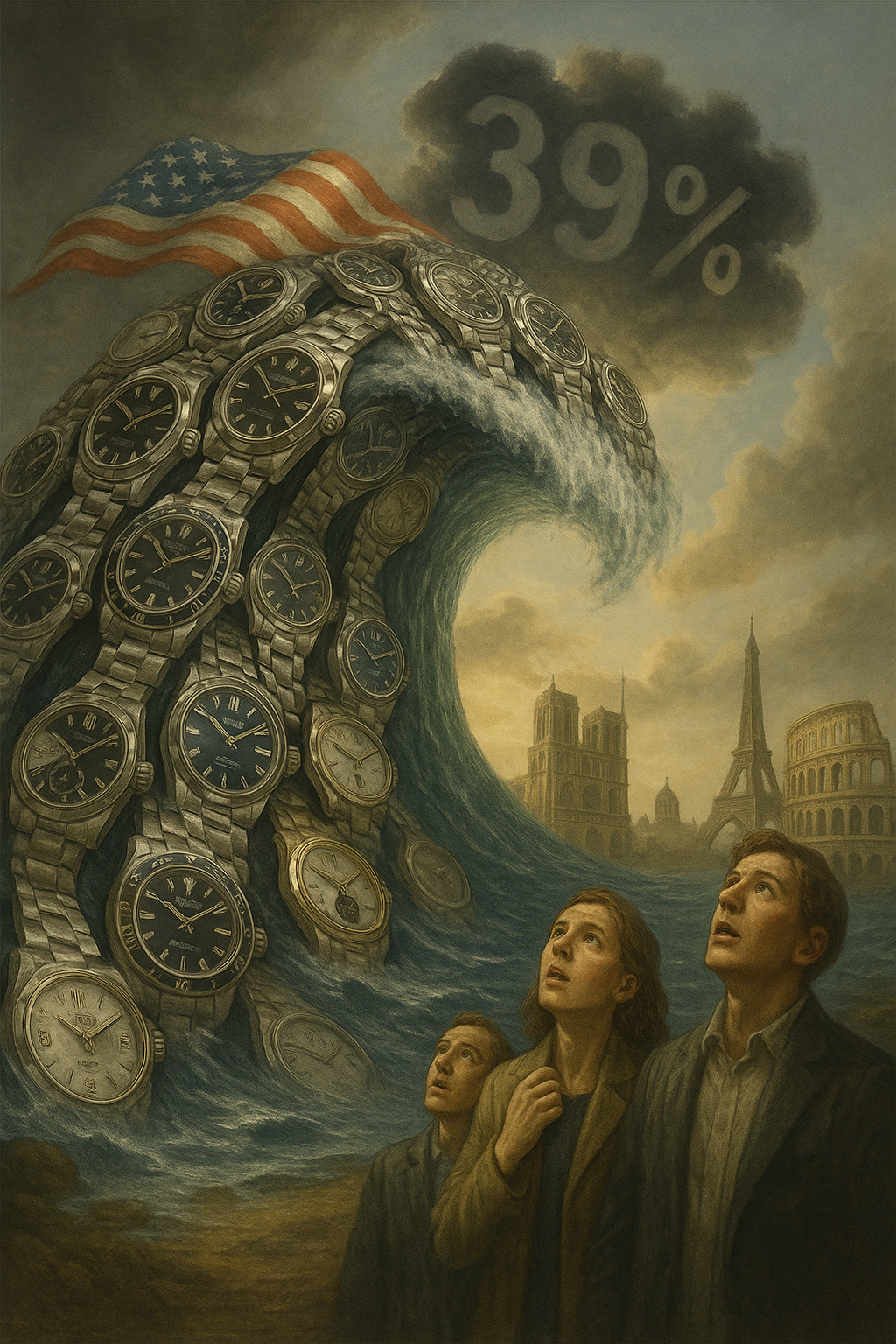

Trump's 39% Swiss Watch Tariff: What It Means for European Buyers

39% US tariffs on Swiss watches hit August 7th. Unless Switzerland pulls a UK-style deal, Europe's about to get crowded with American buyers.

The clock is ticking. In less than a week, Trump's 39% tariff on Swiss watches kicks in on August 7th, 2025. While Swiss diplomats scramble for a last-minute deal similar to the UK's escape, European watch collectors should prepare for an American invasion that could reshape their market.

And if you're sitting comfortably thinking this is America's problem, think again.

The August 7th deadline: hope vs reality

Switzerland is desperately hoping to replicate the UK's success in negotiating down from threatened tariffs. Here's what we know:

- The deadline is August 7th, 2025. Tariffs go live without a deal.

- The stakes: $5.2 billion annual market, roughly 17% of Swiss exports.

- The UK negotiated down to 10% from threatened higher rates.

- Switzerland's $38.5 billion trade surplus makes it a prime target.

President Karin Keller-Sutter has been burning up the phone lines to Washington. The Swiss argument? That $38.5 billion deficit ignores $20 billion in US services exports and 500,000 American jobs from Swiss investment. Trump's response so far has been silence.

Why a deal might not matter anyway

Even if Switzerland pulls off a miracle and negotiates down to 15-20% (best case scenario), the damage is already done.

Market psychology is the first problem. Collectors are spooked. April saw a 149% surge in exports as everyone panicked and front-loaded purchases.

Then there are the price adjustments brands already announced:

- Rolex: 3% (modest but significant at these price points)

- Omega: 8%

- Blancpain: 10%

- Swatch Group average: 8-10% across the portfolio

Grey market dealers report that "importing is dead in the water." They can't absorb even 15% with their margins.

The math driving Americans to Europe (even with a "deal")

Let's be realistic. Even if Switzerland negotiates down to 20%, here's what happens:

A Rolex Submariner after a 20% tariff deal would cost roughly $10,100 in the US. In Europe, with a VAT refund, you're looking at about $8,675. That's $1,425 in savings, enough to justify a flight.

An Omega Speedmaster Professional? About $6,750 in the US versus $5,417 in Europe with VAT refund. $1,333 saved. Weekend in Paris, anyone?

The brutal truth: anything above 10% creates arbitrage opportunities that make European watch tourism profitable.

The timeline: deal or no deal

Between now and August 6th, Swiss diplomats are in overdrive. Dealers are holding their breath on inventory decisions. Smart buyers are positioning for either scenario. European ADs are already seeing increased American inquiries.

On August 7th, two realities could play out.

If a deal lands at 15-20%, expect a partial relief rally in the US market. European prices will still be attractive to Americans, but the shift will be gradual over 6-12 months.

If the full 39% goes through, expect immediate chaos. US luxury watch sales could crater 15-20%. The European market gets flooded within 30 days. Emergency price adjustments follow by Q4.

Why Europe loses either way

The 65% of European luxury consumers who already cross-border shop are about to get a lot more company. Research suggests even a 15% tariff would drive significant American traffic to European retailers.

Oliver Mueller of LuxeConsult puts it plainly: "The mathematics of tariff pass-through reveal why mid-tier brands suffer disproportionately." Translation: your favourite accessible luxury pieces are about to become harder to get.

The Swiss hail Mary

Switzerland's negotiating position isn't terrible:

- Zero tariffs on US industrial goods (moral high ground)

- Major US employment through Swiss companies (political leverage)

- Historical neutrality (diplomatic goodwill)

But Trump picked 39% because it "rounds up nicely" from the trade deficit. That's not the reasoning of someone looking to compromise.

Industry insiders put the odds of a meaningful deal at 30%, and even then, "meaningful" probably means 20-25%, not the 10% that would actually preserve market stability.

What European collectors should do this week

Before August 7th: finalise any purchases you've been considering. Lock in pre-orders with deposits. Document current market prices for comparison. Build relationships with ADs who'll remember you when Americans arrive.

If a deal happens at 15-20%: still expect European price pressure. American tourism impact will be reduced but not eliminated. You'll have a roughly 6-month window before full adjustment.

If no deal and 39% stands: brace for immediate impact. Expect 25-40% European price increases within 6 months. Consider selling premium pieces in Q4 for maximum return. Watch for panic inventory dumps in early August.

The investment reality check

Based on diplomatic sources and market analysis:

- 70% probability: full 39% implementation August 7th

- 25% probability: negotiated reduction to 20-25%

- 5% probability: UK-style success at 10% or less

Even the "best case" creates significant arbitrage. European prices will rise regardless. It's just a question of how fast.

Bottom line

Rolf Studer of Oris put it bluntly: "A 10% tariff we could handle, but 39% is prohibitive." With less than a week until implementation and Swiss negotiations showing little progress, European collectors face a simple choice: act now, or pay more later.

The Americans are coming whether it's 39%, 20%, or somewhere in between. The only question is whether you'll be ready when they arrive.

Days until the tariff deadline. If you've been considering a piece, the market is about to shift. Explore our collection